Building a new home is a rewarding experience that should be among the most exciting times of your life, but it can be overwhelming if not managed right. Not only are there so many decisions to make, but the process of applying for a mortgage, choosing the perfect home design for your needs and finding the right builder to work with can prove complicated. To help you navigate the home building journey with confidence, we’ve created this guide that outlines the most important considerations for first home buyers.

Why build a new home?

There are many benefits to building a new home over buying or renovating an existing home, including getting exactly what you want – without compromising on the layout, fixtures and fittings. Other benefits of building a new home as a new home buyer include:

- Eligibility for grants from the State and Federal Government that can save you money – The grants you may be eligible for include the First Home Buyers Grant, First Home Guarantee Scheme, Family Home Guarantee and the First Home Vacant Land Concession.

- Additional stamp duty savings – As a first home buyer you’ll also find that you’re eligible for additional stamp duty savings when you build a new home rather than buying an existing home, as you only pay stamp duty on the value of the land, not the home you build.

- Avoid hidden problems that can cost you thousands of dollars in repairs and upgrades – Even with a thorough building inspection, unexpected issues can arise when buying an existing home that can exponentially increase the short and long-term costs involved.

Is building a new home the right option for you?

Before embarking on the home building process it’s crucial to make sure that building a new home is the right option for you. There are many questions to ask yourself before getting started, such as:

- Is the time right for you to build a new home? – The process of building a new home takes time which you’ll need to factor in, but you should also make sure that it’s the right time for you and your family personally.

- Are you able to buy land in your desired location? – Have you found the right area to buy in and do you have the finances to do so? Some buyers find it advantageous to buy the block of land first and then save the remainder for a deposit.

- How much money do you have and how much do you need to borrow? – Building a new home is one of the biggest investments most people will make and it’s so important to make sure you’re prepared financially.

- Are you in a rush to leave your current residence? – If you’re comfortable where you are, it may prove advantageous to take a bit more time to save for the deposit and decide on the right home design and home builder.

Financing your new home – Building within your budget

A golden rule when it comes to building a home is ‘build within your means’ – while building a new home is likely to be the biggest investment you’ll ever make, naturally, you’ll want to enjoy a rewarding lifestyle in your new home and not constantly stress about making the repayments.

The bigger the house, the higher your mortgage repayments, so be sure to think carefully about what you can afford when planning your home. Moreover, it’s essential to recognize that the builder’s estimate may not include various items, such as electrical and gas meters, landscaping, and window and floor coverings. Factor in these potential additional costs, along with considerations like site preparation, when creating your budget. Don’t forget that there are a range of State and Federal Government grants available, but you need to ensure that you’re eligible for these grants before factoring them into your home building budget.

Financing your new home – Deposits, mortgages and insurance

When you have a clear idea of your budget you’ll better understand how much you need to save for the deposit for your new home. Banks and lenders have minimum deposit requirements for home loans and they’ll want to see that you’ve saved enough for the deposit and can cover buying costs. If you’re still in the planning stage, aim to save a minimum of 7% – this will cover the 5% minimum deposit to secure the property and buying costs which are around 2%. This is the bare minimum for a deposit and you will likely need to save much more, so be sure to discuss your plans with a lender or mortgage broker to get a solid understanding of how much you need to save for the deposit.

One of the primary considerations when saving for a deposit is Lenders Mortgage Insurance (LMI). This insurance policy is intended to protect your lender in the event that you can’t repay your loan and there’s a shortfall in the outstanding amount owed on the loan. But not all homebuyers need to pay LMI – if your home loan deposit amounts to more than 20% of the value of the property (which means the loan to Loan-to-Value Ratio (LVR) is 80% or more), you won’t have to pay LMI. Not having to pay LMI is a popular reason among home buyers for saving at least 20% or more of the property value.

Finding the right lender is such an important factor in the home buying process and you need to be confident that your home loan will meet your building requirements. What’s more, you also need to know how to get the most out of it – not all loans are created equally and it really does pay to make sure that you’ve secured the right loan through the right lender. Some buyers find it advantageous to work with a mortgage broker to have access to a wider range of lenders while others prefer to source a suitable lender themselves. Regardless of how you choose to arrange finance, make sure you’re confident about the loan and the lender before signing on the dotted line.

Finding and buying the perfect block of land

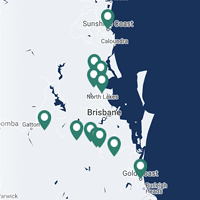

Location, location, location! Choosing the right area is such an important factor when building a new home, after all, it’s where you’ll be calling home for the foreseeable future! Location isn’t only important in terms of the suburb that you’ll build in, but be sure to consider more immediate factors, like the street the block is located, and the amenities in the local area, including schools, shops and hospitals. Further considerations to bear in mind when buying the perfect block of land include:

- Block size and orientation – The width and depth of the block indicate how small or big you can build, while the block orientation has a direct impact on how the home is designed.

- Council restrictions or estate guidelines – Councils differ across town planning guidelines and building regulations, while estates can set restrictions for colour schemes and facade styles.

- Historical property value trends – Different areas appreciate in value at different rates, which makes choosing the right suburb such an important aspect of the home building process.

- Proposed developments in the area – The developments planned can impact the value of the property and the appeal of living in that area, so thoroughly research your areas of interest.

Choosing the right home design and home builder

As building a new home is probably the single biggest financial investment you’ll ever make, make sure you choose a ‘future-proof’ home design that will last the distance and a home builder that you feel confident about building with. These are two of the most important factors involved!

This ensures your new home will continue to increase in value – and not just monetarily, but also in terms of the value you derive from living there. After all, for most people, building a new home is a long-term prospect, so choose a house plan that meets both your current and future lifestyle needs and work with a home builder who will deliver a quality build and a smooth home building process.

With the recent implementation of the new National Construction Code (NCC), be sure to focus on home designs that seamlessly align with the new requirements of acceptable housing standards in Queensland. Some of the most important considerations when building a new home include:

- Choosing a home design that allows for growth – The best home design is one that meets your changing needs, so consider how your family’s lifestyle will change over the coming years. Hallmark Homes presents a diverse selection of home designs to cater to various preferences. Nest by Hallmark, is particularly tailored for families and those seeking a home that facilitates future growth.

- Opt for timeless inclusions and upgrades – Avoid trends that will become outdated quickly and opt for inclusions and upgrades that will stand the test of time and appreciate in value.

- Focus on design flexibility – Opt for a home design that incorporates multifunctional spaces, allowing rooms to serve various purposes based on your needs. This flexibility ensures that your home can adapt to changing circumstances.

Thinking of building a new home in South East Queensland this coming year? Contact Hallmark Homes to speak with an experienced consultant, visit one of our display centres for home design inspiration, or check out our house plans with a virtual tour from the comfort of your own home. If you have any questions about our single storey, double-storey, acreage, narrow lot, or the house and land packages we currently have available, please contact us today.

As the purchase of your first home is probably the biggest financial commitment you’ll ever make, approaching the process with careful planning right from the start is crucial. This is why it’s so important to build with a trusted home builder like Hallmark Homes and have a strong understanding of the first-home construction process. To get started, download our ‘Building Your Very First Home – An Essential Guide’ which helps you navigate through the process of building your very first home.