In Queensland, as in other states and territories, when you buy real estate (land or property), you have to pay stamp duty (also known as ‘transfer duty’). As QLD stamp duty needs to be paid within 30 days of the contract becoming unconditional or the transfer of the ownership (whichever occurs first), you must factor this cost into the purchase price of your new home.

Here we look at what stamp duty is, how it’s calculated, who pays it and when it’s payable, the current QLD stamp duty rates (2023) and the concessions you may be eligible for, including the ‘first home concession’.

What is stamp duty?

Stamp duty is a one-off government fee that is imposed following the transfer of a title, whether it’s for residential, commercial or investment purposes. While stamp duty is payable on all property purchases, what you plan to do with the property affects the amount of stamp duty you’ll pay, as do a variety of other factors, including whether you’ve purchased the property in the past. As such, if you’re planning to live in your home rather than invest, or you’re a first-time home buyer, you could be eligible for a discount on the stamp duty payable.

Who pays stamp duty in QLD?

In Queensland, stamp duty is paid by the person purchasing the property, not the seller. As the duty payable can amount to a significant additional cost, to have a clear understanding of your financial obligations as a property buyer, you need to estimate the transfer tax payable on the purchase and factor this into your budget.

How is stamp duty calculated?

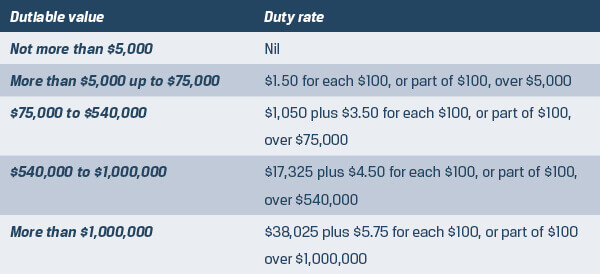

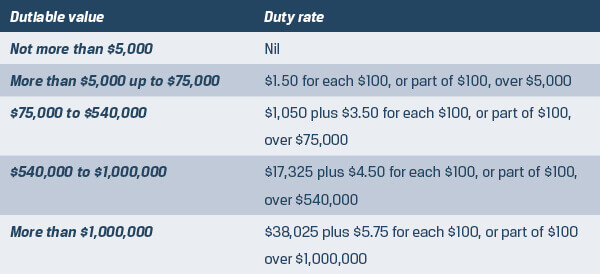

Whether you’re planning to live in the property you’re purchasing or you’re buying it as an investment, stamp duty in Queensland is calculated on the value of the property. As the duty payable is calculated on the market value of the property, the more expensive the asset, the higher the stamp duty rate that you’ll have to pay.

For example, if you were buying a $400,000 property as your principal place of residence, the stamp duty would be $12,425, excluding any first-home buyer concessions.

What are the stamp duty rates in Queensland?

Each state and territory in Australia applies stamp duty differently, so not only do individual rates vary from state to state, but there are also different purchase thresholds and exemptions that property buyers need to understand. This makes it important to understand exactly how to calculate payable duty – or apply for any concessions for which you may be eligible – when purchasing a home, whether to live in or as an investment.

In 2023, general stamp duty rates in Queensland are as below (please note that these are subject to change):

What is the process?

In Queensland, stamp duty is payable to the Office of State Revenue. Before you make a payment, you must lodge all of your documents and forms for assessment, within 30 days of signing. The documents may be lodged with either the Office of State Revenue or a registered self-assessor, like a solicitor. You’ll then receive a notice of assessment, which tells you the amount of stamp duty that you need to pay.

When is stamp duty due?

Stamp duty is payable once you receive notification that your documents have been assessed. If you’re borrowing money, your lender will probably require you to have these documents stamped before the loan can be settled, so you’ll need to pay the stamp duty before this.

With this, it’s important to remember that the longer you take to pay stamp duty, the longer it will take for you to be legally recognised as the new owner of the property – and after a certain time, additional interest and fees may start to accrue.

What stamp duty concessions are available in Queensland?

Queensland offers a ‘first home concession’ to eligible first home buyers over 18 years of age who intend to live in a property as their principal place of residence for a minimum of 12 consecutive months after moving in, and have never previously owned property or land or claimed the vacant land concession. The QLD first home concession, which is deducted from the home concession amount, may be claimed on properties valued up to $549,999 and could save you up to $15,925. Hallmark Homes’ variety of home designs may suit your requirements.

If you’re purchasing a home over $550,000, you may still be eligible for the ‘home concession’ which could potentially save you up to $7,175 when buying a home in which to reside. There’s also a first home vacant land concession that may be claimed on land valued between $250,000 and $399,999. For land valued at less than $250,000, a full exemption may be claimed.

Always check with your lender to ensure eligibility before factoring any discounts. You can use the Queensland Government’s ‘Transfer duty estimator’ to calculate how much stamp duty you may need to pay here.

Hallmark Homes give you more home for your money

With over 40 years of experience building quality homes, Hallmark Homes offers a fantastic selection of quality homes at unbeatable value. So, if you’re thinking of building a new home in South East Queensland, the team at Hallmark Homes is ready to help. Check out our homes for yourself at one of our display centres across Brisbane, Gold Coast and Sunshine Coast, including our new display homes at Aura (Bells Creek), Shoreline (Redland Bay) and White Rock. If you have any questions about our home designs or house and land packages, contact us today.

This is general information only. Current as at October 2023. Stamp duty is subject to change. For more details, contact your lending institution or visit Queensland Treasury.