Saving for your first home deposit can be a challenge! Quite simply, there is no magic formula. It comes down to discipline, determination, sticking to a budget and having a savings plan. And the sooner you start saving, the better! Here are our top tips for making your dreams of becoming a home owner a reality sooner.^

Tip 1: Apply for the First Home Owners’ Grant

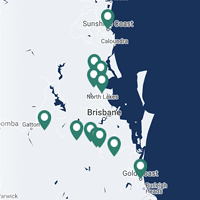

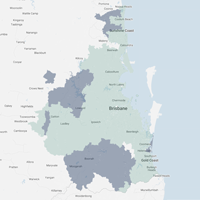

The Queensland First Home Owners’ Grant is a state government initiative designed to help first home buyers get into the property market sooner. The grant now offers $30,000 towards buying or building your new first home, valued at less than $750,000, and is available until 30 June 2026. If you’re unsure about the application process, reach out to the friendly team at Hallmark Homes – we’re here to guide you. While the grant is a fantastic boost to your deposit, you might need a bit more to cover the rest, so here are some practical tips to help you grow your savings. Learn more about how Hallmark Homes can help you take your first step towards owning your first home.

Tip 2: Divide and conquer

Before you pay for anything else, put money into your home deposit savings account first. If you make it a priority, this will ensure that your deposit grows quickly. If you leave it until last, after you’ve paid for everything else, chances are there will be nothing left! It’s best to open a separate bank account, preferably a high-interest savings account that you can’t easily access, so you won’t be tempted to dip into it for spending money. Even better, set up an automatic transfer for every payday (10% of your net pay is a good goal to aim for), and if you have any left over money, top up your account whenever you can.

Tip 3. Less luxuries, more savings

You’d probably be surprised just how much you spend per month on luxuries like coffee, takeaway and Netflix! Cutting out just a few of these can save you heaps – which can go straight into your home deposit savings account. Don’t deprive yourself of all treats though – you still need to have some fun, after all! As a guide, start by eliminating one luxury a month. Over a twelve month period, you could save thousands of dollars by simply alternating between luxuries!

For example, you could:

- Take your lunch to work everyday for a month – save $200

- Don’t buy any new clothes for four weeks – save $300

- Skip coffee for a month – save $200.

Tip 4. Delete debt!

Don’t throw money down the drain on interest payments! Pay off all your credit cards, personal loans and any other debts straight away, if you can. If you’re not sure how to do this, ask your bank for some helpful strategies. Reducing or eliminating your debt will help increase your borrowing power. This means it will increase the amount of money you can borrow, and free up cash you can use for mortgage payments.

Tip 5. Budget, budget, budget…

There’s no getting around it. You need to make a budget and stick to it. Working out a realistic budget is a great way to take control of your finances. Although it may seem like a chore, it’s the crux of sound and sustainable financial management. It’s easy to underestimate expenditure by overlooking occasional costs, so make sure you take everything into account. Keeping a financial diary for a month can be a great way to see how much you’re really spending – you may be surprised! Group your spending into cost categories like home, clothing, food, transport, etc. Remember, the best budgets are realistic and don’t work on ‘best case’ scenarios.

Why first home buyers choose Hallmark

Hallmark offer a great range of quality, affordable homes, specially suited to first home buyers. We understand that building and owning your first home can be an exciting, but sometimes it can be a little daunting too. That’s why our experienced team is here to help you every step of the way, whether it’s with design, house and land packages, or even colour choices.

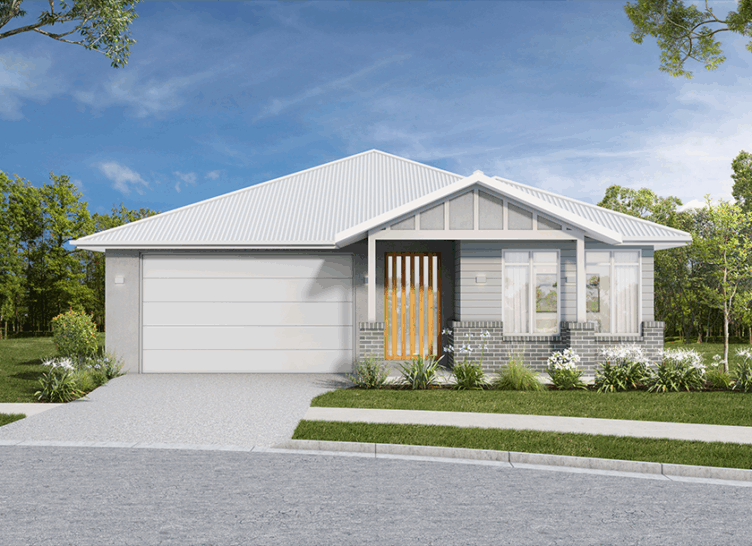

From $119,800, you can’t beat our Eclipse Series!

Our Eclipse Series is the most popular range amongst first home buyers, due to its outstanding value for money. With 14 designs to choose from, the Eclipse Series is perfect for young couples, growing families or empty nesters. Once you’ve selected the design best suited to you, our specialist team will guide you through the build process, so you don’t have to worry about a thing!

Stephanie Long, Hallmark Homes’ Director of Sales & Marketing can well remember the excitement of being a first home owner. “That’s why we’ve put so much time and effort into the Eclipse Series. We wanted to give first home owners a quality home at an affordable price, and this range certainly ticks all the boxes!”

The team at Hallmark Homes is ready to help you with any queries you may have regarding your new home. If you have any questions about our home designs or house and land packages, please contact us today.

*The Queensland First Home Owners’ Grant is a government initiative which is subject to change. Details were correct at the time of posting. ^These tips are for general information purposes only. They have been prepared without taking into account your objectives, financial situation or needs. Before acting on this advice, you should consider the appropriateness of the advice, having regard to your own objectives, financial situation and needs. Please consult a financial expert for information that relates specifically to your circumstances.