Thinking about buying an investment property? Whether you are thinking of buying a second home as an investment property or you’re ready to start your journey in the property market as an investor, you might find the process exciting, but also a little daunting. To help you get off to the right start on your property investing journey, here’s what you need to know about buying an investment property in Queensland.

What are the pros and cons of investing in property?

Property investment is often seen as a less risky option than other investment types, like shares or cryptocurrency, for example. While it can be a more straightforward investment, significant capital is involved and there are, as with all investments, pitfalls that you need to be aware of. The pros and cons of investing in property may include:

Pros of investing in property

- Less volatility than other investments. Compared with shares and some other investments, property is considered a less risky option due to lower volatility.

- Potential for income and capital growth. When the property is tenanted you could earn income and benefit from capital gains if it increases in value when you sell.

- Potential for tax deductions. Most property expenses, like interest on the mortgage used to buy the property, can be offset against the income.

Cons of investing in property

- Interest rate increases. If interest rates rise, your mortgage repayments will increase and may not be covered by the rental income received.

- Lack of flexibility. Unlike shares and some other investments, property is rather inflexible, so you can’t sell a portion of your investment if you need cash urgently.

Yes, there are pros and cons to investing in property, but there are pros and cons to all investments – you have to do your research, get professional advice where needed and make sure the investment you decide upon is the right one for you. This is especially important with property due to the range of potential investment strategies to leverage:

- Buy and hold. A long-term strategy focusing on capital gains to create wealth.

- Positive cash flow. A medium to long-term strategy focusing on income generation.

- Negative gearing. A short-term strategy used to legally reduce tax liabilities.

It isn’t uncommon to start your property investment journey leveraging one strategy and then switching to another in the future, but you must have a strategy. As such, it’s crucial to have a strong idea of what you want to achieve when buying an investment property.

How much does it cost to invest in property?

With higher entry costs than other investment types, it’s very important that you get your finances right. This not only means proving to the lender that you can afford the loan, but having a complete understanding of all the costs involved in buying a property, such as:

- Purchase costs. How will you pay for it, are you using equity from another property and how much deposit do you need?

- Holding costs. You need to show that you can repay the loan, so make sure you can afford it, even without tenants.

- Stamp duty. When you build a new home you save costs on stamp duty – as you only pay stamp duty of your land, not the house itself! Learn about stamp duty in Queensland here.

- Lenders Mortgage Insurance (LMI). This applies when borrowing more than 80% of the property’s purchase price.

- Conveyancing costs. You need to enlist the services of a conveyancer to handle the purchase process on your behalf.

Also, one of the primary reasons people invest in property is capital gains, so while there’s the potential for market fluctuations that see property prices rise and fall, overall, property values rise. This means the longer you wait to start your journey, the higher the entry costs.

How will you finance your investment?

Following on from the previous point, you generally need a large amount of savings to secure an investment property, with most banks and lenders insisting on a full 20% deposit to avoid LMI and other extra fees and charges. Additionally, as you’ll need an ‘investment loan’ rather than an ‘owner occupied loan’ which banks and lenders consider riskier due to market and vacancy concerns, you’ll sometimes pay higher interest rates and fees.

These are some of the many considerations when working out how you’ll finance your investment, and whether you decide to use a broker or approach banks and lenders directly, consider getting loan pre-approval early on in your home-buying journey. Having loan pre-approval helps to give you a clearer picture of what you’re likely able to spend on an investment property based on what the lender is prepared to lend to you.

Are you ready to be a landlord?

Chances are you’ve been a tenant at some point and perhaps you thought your landlord had it easy and just kicked back while the money rolled in. Think again! There are many things involved in buying and leasing an investment property to tenants and the process starts well before you’ve purchased the property. Ask yourself the following questions:

- What’s the right initial investment strategy? As mentioned, you may change your investment strategy in the future, but you need to choose the right one to start with.

- What’s my budget for buying the property? It’s a good idea to get loan pre-approval early on in your home-buying journey to help set a clear budget for the purchase.

- What rental returns is it likely to achieve? To achieve high rental returns, you need maximum occupancy rates, so the property must be desirable to potential tenants.

- What will the impact on my cash flow be? The ideal investment property achieves strong rental returns and capital growth with minimal overheads and expenses.

- Should I manage it myself or use an agent? Property agent fees are an expense but having an agent manage the property can potentially deliver higher overall returns.

In terms of whether you’re ready to be a landlord, these are just some of the many things that you’ll need to consider before and after you buy. What’s more, you also need to ask yourself if you’re ready to take on the financial commitment – with all that entails – of being a landlord. While property can prove to be a great investment, there is often a significant amount of capital involved in becoming a landlord.

Should you build a new home or buy an existing property?

One of the most important decisions you’ll make on your investment property-buying journey is deciding on a property type (e.g. apartment, townhouse or house) and whether to build a new property or buy an existing home. Although buying an existing property is a popular option among those seeking a property as an investment, building an investment property also has a lot to offer. Building a new home offers benefits, such as enabling you to:

- Combine the right block with the right design. Building a new property enables you to control the way the property looks, starting with the floor plan through to the fixtures and façade.

- Build a low-maintenance home. Even with a building inspection report, buying an existing property will inevitably see you paying for repairs while building enables you to minimise maintenance.

- Build to meet market demand. What are tenants looking for? When you know what potential tenants in the area want, you can build an investment property that ticks all their boxes.

- Take advantage of tax incentives. There are several tax deductions that you can claim for a new-build investment property, such as claiming depreciation on internal fixtures and fittings.

- Potentially build equity faster. While you shouldn’t see it as a guarantee, once the build is complete you could have it revalued and if it’s higher than the initial value, you’ll have added equity.

- Focus on properties in high-demand areas. In high-growth regions like South East Queensland, you’ll find there are many high-demand areas that are ideal for building an investment property.

- Choose a property that fits your goals. Building a new property may provide ample options in terms of where you build, the size of the block and home, enabling you to build to suit your goals.

What’s more, there’s also the potential to save more when building instead of buying an investment property. That’s because, in some cases, building a new property could be more affordable than buying an existing one. However, that depends on certain criteria, such as getting a good deal on the land and building costs and working with the right home builder. While some investors choose to purchase an existing property – often at a higher cost – to avoid the building time and get tenants in as soon as possible, if you have the option of taking your time, there’s the potential to save more money by building a new property.

What about house and land packages?

House and land packages can be an excellent way to get into the property market while enjoying many of the same benefits of building a new home, such as capital growth, depreciation and and a range of additional tax benefits afforded to investment properties. However, there are additional benefits to buying a house and land package, starting with the potential for increased affordability and the peace of mind that a set purchase price provides. What’s more, you can save significantly on stamp duty if you opt to buy a house and land package, reducing the entry costs to property investment.

Learn more in our guide, ‘Essential Questions to Ask When Buying a House & Land Package’.

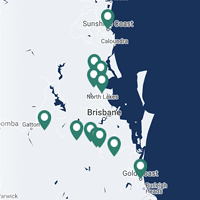

As a trusted local home builder, Hallmark Homes has a strong presence across South East Queensland and builds new homes for all kinds of homebuyers, from first-home buyers to downsizers and property investors. We have display homes in many popular areas to build a new home, including Brisbane suburbs like Redland Bay and Burpengary East, Gold Coast – including our new SkyRidge display home in Gold Coast – and Aura on the Sunshine Coast, making it easy to view our homes and get a feel for our design and build quality. We also offer house and land packages in high-demand, high-growth areas – please don’t hesitate to contact our experienced consultants to learn more about the packages we have available or for help planning your display home visit.

Disclaimer

The information on this website is for general information purposes only. It is not financial advice. Consult with qualified financial advisors for personalised guidance.