- Building with Hallmark Homes

- First Home Buyers

- First Home Guarantee Scheme

First Home Guarantee Scheme

Previously ‘First Home Loan Deposit Scheme’

The First Home Guarantee makes it easier for eligible buyers to step into a new home with a smaller deposit. With as little as 5% deposit, you can secure your home without paying Lenders Mortgage Insurance, as the Australian Government provides your lender with a guarantee of up to 15% of the property’s value. For single parents and single legal guardians, a Family Home Guarantee option may allow you to buy with just a 2% deposit.

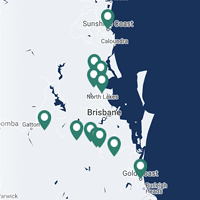

From 1 October 2025, the Scheme was expanded to give first home buyers even greater opportunities. There are now no income caps, no limit on the number of places available, and property price caps have been lifted across the country. In Queensland, the cap for Brisbane, Gold Coast and Sunshine Coast has increased from $700,000 to $1,000,000, making it easier for more people to find a home in these popular areas. Applications are made through Participating Lenders only.

To learn more about eligibility, property price caps and how to apply, please visit the official Australian Government website: firsthomebuyers.gov.au

The information on this website regarding first home buyer grants and schemes provided by Hallmark Homes is for general information purposes only. It is not financial advice. Consult with qualified financial advisors for personalised guidance.

5%

minimum deposit.

No LMI

Lenders Mortgage Insurance waived.

$700,000

Property Cap in Brisbane, Gold Coast and Sunshine Coast.

How does the First Home Guarantee Scheme work?

Administered by the federal government, the First Home Guarantee Scheme is designed to break down barriers to homeownership for first-home buyers by enabling them to purchase their first home with just a 5% deposit, and also, without having to pay Lenders’ Mortgage Insurance (LMI).

LMI is usually applicable when borrowing more than 80% of the property value (i.e., borrowing with less than 20% deposit) and is calculated as a percentage of the loan and varies depending on the total amount of the loan and the Loan to Value Ratio (LVR). However, with the First Home Guarantee Scheme, the Government acts as a guarantor so that you don’t have to pay LMI.

Frequently Asked Questions

No. The Guarantee is not a cash payment or grant. It is a government-backed guarantee that allows you to buy with a smaller deposit and avoid Lenders Mortgage Insurance.

Most first home buyers need a minimum 5% deposit under the First Home Guarantee. Single parents and single legal guardians may qualify for a 2% deposit option under the Family Home Guarantee.

From 1 October 2025, the cap for Brisbane, Gold Coast and Sunshine Coast is $1,000,000, while the cap for other areas of Queensland is $700,000.

Yes. If you meet the eligibility rules for both, you can use the Queensland First Home Owner Grant together with the First Home Guarantee. This can help with upfront costs while also removing LMI.

Need further information?

For further details on the First Home Guarantee Scheme, please visit the official Housing Australia website.

*The information on this website regarding first home buyer grants and schemes provided by Hallmark Homes is for general information purposes only. It is not financial advice. Consult with qualified financial advisors for personalised guidance.

Eligible House and Land Packages

| Kawana 159 - Luma - Harmony | |

| Floor Area | 162.02m2 |

| Land Area | 280m2 |

- 3

- 2

- 2

- 2

You might be interested in:

Book an appointment at display centre

Fill out the form below and a sales consultant will contact you to confirm your appointment.

Thanks!

A sales consultant will contact you soon to schedule an appointment on your selected day.

Processing